Our latest insights

List of articles

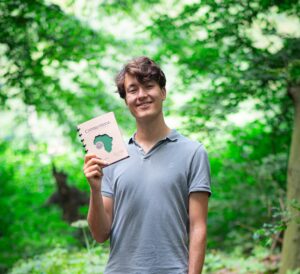

Case Study: A Strategic Collaboration with Correctbook

Notes on Growth with Correctbook. A mission-driven growth requires more than energy and intent. It also asks for clarity, governance, and space to grow without compromising on purpose. Read more about the strategic collaboration with Correctbook.

Case Study: A Strategic Collaboration with Correctbook

Notes on Growth with Correctbook. A mission-driven growth requires more than energy and intent. It also asks for clarity, governance, and space to grow without compromising on purpose. Read more about the strategic collaboration with Correctbook.

How Climate Change is Shifting the Housing Market

Climate risks are already impacting real estate values and insurance costs. This article explores how housing markets are adapting to rising floods, fires, and other climate threats.

Case Study: Making Electric Aviation Real with Cormorant

Discover how RiskSphere helped Cormorant turn its bold electric aviation vision into a clear, investor-ready strategy. From financial modeling to market entry, the collaboration laid the groundwork for sustainable, inclusive air mobility.

Unlocking the Power of ESG: How Systems Thinking Drives Smarter Sustainability Decisions

Proactively managing ESG risks drives smarter, more resilient business decisions. Using systems thinking, companies can better assess sustainability investments and unlock long-term value and competitive advantage.

Creating value through strategic ESG

ESG is more than a requirement. It’s a competitive advantage. Companies that integrate ESG into their core strategy unlock innovation, resilience, and long-term value. Explore how strategic ESG can drive real business impact.

ESG Disclosures and Company Value: What Every Business Needs to Know

Explore how ESG disclosures impact company value, from investor confidence to regulatory trends like CSRD. Learn how transparency drives growth and resilience.

Regenerative Finance (ReFi)

Discover how Regenerative Finance (ReFi) is reshaping financial systems by prioritizing sustainability and social well-being.

No Business is an Island: Embracing Systems Thinking

Businesses often overlook the interconnected systems around them, creating gaps in understanding. Systems thinking bridges this, offering a broader view and tools to adapt. This article lays the foundation for adopting this approach.

Climate Change Communication: what are we doing wrong?

Discover how a psychology-informed approach can transform climate change communication, with Flavia Loner’s insights at RiskSphere. Learn how innovative approaches inspire action and hope in the climate crisis.

Decoding the Alphabet Soup of ESG Standards and Frameworks

Explore the ESG Standards and Frameworks that help you stay compliant and reduce risks.

Traversing the EU Climate Regulation Jungle

The EU Climate Regulation, Green Deal, adopted in 2019, aims to make the EU climate-neutral by 2050. It sets the stage for global regulatory alignment, with impacts on both the financial and corporate sectors.

Natural Capital at Risk: Biodiversity risks, regulation, and steps forward

Biodiversity loss creates major risks for businesses. Using the LEAP framework, organisations can identify and manage these risks. RiskSphere can help you navigate these challenges and develop tailored strategies.

The Planetary Garden: Humankind in the Garden of Good and Evil

The article highlights the vital link between biodiversity and business, urging the integration of biodiversity into strategies. It also addresses the complexities of ecological restoration, crucial for mitigating risks and ensuring growth.

Strengthening Financial Resilience: Macroprudential Policy Against Climate Risks

This article delves into the application of macroprudential tools for effective climate risk management within the banking sector, following a recent research paper from the European Central Bank (ECB).

Case: Helping a Dutch bank improve ESG risk management

Discover how RiskSphere contributed to an improved (ESG) data management framework, adding to a solid framework for managing risk and finance data.

The Corporate Sustainability Due Diligence Directive: accountability and opportunity are knocking!

The CSDDD, passed on April 24th, 2024, mandates large companies to manage sustainability risks, with fines up to 5% of turnover for non-compliance. Starting in 2027, it emphasizes risk management, stakeholder trust, and operational efficiency.

A Dual Approach to Transforming the Financial Sector

Explore how the financial sector can bridge its 'purpose gap' through regulatory reforms and cultural shifts, crucial for sustainable economic practices. Dive into the dual approach outlined in this article.

The End of Risk and the Last CRO: How Climate Adaptation Will Change Your Business Forever

Discover how climate adaptation is reshaping risk management forever. From the notion of a "risk singularity" to the evolving role of CRO's, explore the profound changes ahead.

Harnessing the Power of ESG Dashboards in Climate Risk Management

Discover the influence of EU sustainability and ESG criteria on the insurance sector, the hurdles in embracing these frameworks, and strategies for adapting to evolving regulations for enhanced climate resilience.

Solvency II and Sustainability: The EU’s ESG Mandate for Insurance Companies

Explore how EU sustainability and ESG standards impact insurance, the challenges of adopting these measures, and ways to navigate the changing rules for climate resilience.

Climate risk stress testing: From predictions to preparedness

Mastering climate risk stress tests is vital for financial institutions. With European mandates in play, understanding the nuances is key. Explore the future of climate-conscious finance.

Degrowth: Finance’s secret weapon against climate chaos

This article emphasises the financial sector's role in the climate crisis and its post-growth potential. It urges the sector to align with planetary limits and champion social impact.

Climate risk management: Navigating the heat in a changing world

Learn how the latest changes (IPCC report) can impact your business and how to harness the power of scenario analysis and stress testing to drive sustainable growth.

ESG and the necessity to adapt

This article delves into the history and significance of ESG, exploring its origins, key dimensions, and the pressing need for its adoption in today’s business landscape.

Helping a Dutch Promotional bank understand ESG risks and opportunities

Discover how RiskSphere improved a Dutch bank's ESG risk management, building a robust framework for risk identification, stress testing, and scenario analysis, enhancing policy and insights.

A word from our partner Henk-Jelle: The guiding values of RiskSphere

Our partner Henk-Jelle shares his journey to establishing RiskSphere and sheds light on the values that define our company's operations.