This article delves into the application of macroprudential tools for effective climate risk management within the banking sector, following a recent research paper from the European Central Bank (ECB).

Strengthening Financial Resilience: Macroprudential Policy Against Climate Risks

Adapting Macroprudential Tools for Climate Risk

RiskSphere provides insights on adapting the Systemic Risk Buffer (SyRB) to address the unique challenges posed by climate risks. The discussion encompasses the following key areas:

- Enhancing Prudential Frameworks: Discussion of essential role of prudential measures that complement climate risk management frameworks to uphold financial stability.

- Systemic Impact of Climate Risks: Examination of how the inherent systemic nature of climate risks necessitates a comprehensive approach, integrating both microprudential and macroprudential tools.

- Evolution of the Systemic Risk Buffer: Introduction of the SyRB as a pivotal instrument for managing systemic financial risks, with a focus on its necessary evolution to tackle climate-related issues.

- Calibration Innovations for the SyRB: Exploration of the ECB’s innovative calibration methodology that potentially transforms the SyRB into an effective Climate SyRB, enhancing its utility in managing systemic climate risks.

- Practical Considerations for SyRB Implementation: Discussion on the practical steps and considerations for implementing a climate-adapted SyRB, emphasizing RiskSphere’s expertise in Climate Risk Management.

Recognizing Climate Risks: Regulatory Responses and Frameworks

As regulatory bodies such as the European Central Bank (ECB) work to ensure a stable financial system, the recognition of climate change and its associated financial risks has become increasingly prominent. This recognition has led to a widespread consensus that the financial sector must play a pivotal role in the transition to a sustainable, low-carbon economy. However, this transition is not without challenges, as the sector itself is also significantly impacted by climate change, facing both physical risks, such as extreme weather events, and transition risks, such as policy changes and shifting market demands.

In response to these risks, comprehensive policies have been developed to mandate how banks should integrate climate risk into their risk management and regulatory frameworks. One of the most notable examples is the ECB Guide on Climate and Environmental Risks, published in November 2020. The guide outlines 13 supervisory expectations across four key areas: (i) business models and strategy, (ii) governance and risk appetite, (iii) risk management, and (iv) disclosures. While these policies are crucial for enhancing the resilience of individual firms against climate risks, managing these risks requires additional prudential measures.

Discover how RiskSphere helped a Dutch bank improving their ESG Risk Management Framework.

From Recognition to Response: Tools for Climate Risk Management

Effective management of climate risks necessitates a robust mix of microprudential and macroprudential instruments. Microprudential instruments focus on safeguarding firms from idiosyncratic risks—those risks specific to individual firms—and preventing them from taking excessive risks. In contrast, macroprudential instruments look beyond individual firms to consider systemic risks that can impact the entire financial system. These systemic risks involve interactions between financial institutions and feedback loops between the financial system and the real economy, such as widespread economic downturns or financial crises.

The critical role of macroprudential instruments becomes especially pronounced when managing the systemic impacts of climate risks. As detailed in a report by the ECB and the European Systemic Risk Board (ESRB), climate risks exhibit several unique characteristics that categorize them as inherently systemic:

- Irreversible Nature: Once a climate risk materializes, it is unlikely that the associated losses can be recuperated.

- Insurance Limitations: The concentration and correlation of climate events significantly challenge diversification, making insurance firms reluctant to provide coverage.

- Likelihood of Tail Events: The non-linear effects of climate change and potential tipping points increase the likelihood of extreme events.

- Risk Complexity: The inherent complexity of climate risks, particularly the interactions and feedback loops between physical and transition risks, complicates their measurement using traditional risk management metrics like expected losses.

- Long-term Risk Estimation: The uncertainty over the scale and timing of climate risk materialization, coupled with reliance on imperfect historical data, often leads to underestimation of these risks.

Systemic Risk Buffer: A Macroprudential Tool for Climate Challenges

Reinforcing this perspective, a report by the Financial Stability Board (FSB) asserts that microprudential tools alone are inadequate for managing climate risks due to their systemic nature, underscoring the need for macroprudential tools. The ECB-ESRB report on macroprudential frameworks for managing climate risk specifically highlights the Systemic Risk Buffer (SyRB) as well-suited tool for tackling climate-related risks. Designed to manage systemic threats, the SyRB offers the flexibility to be applied across the entire banking system or targeted to specific segments facing significant systemic risks. This adaptability makes it a potential cornerstone for integrating climate risk management within macroprudential frameworks.

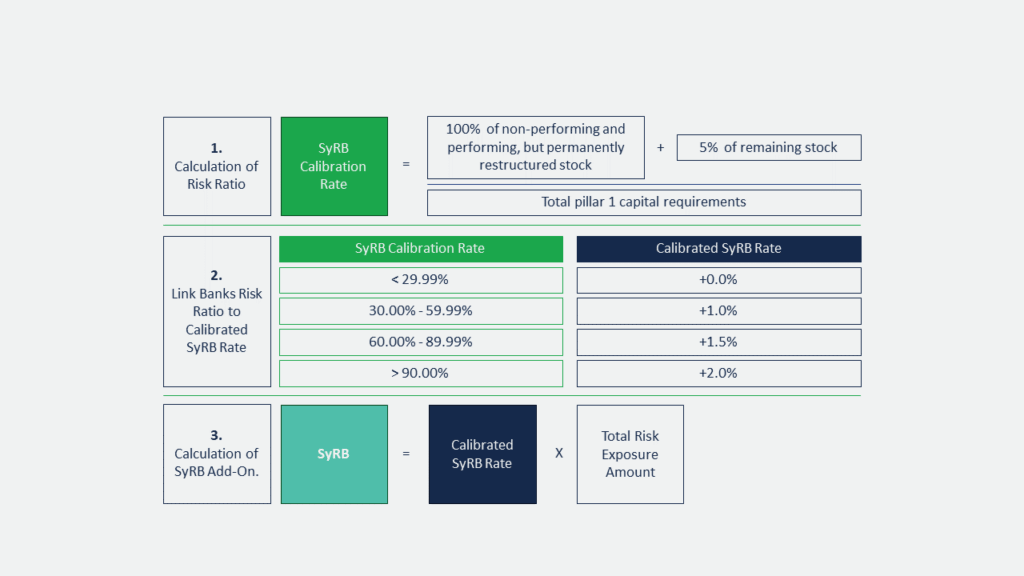

The SyRB is calculated as a percentage of the total risk exposure amount of each bank, effectively aligning the buffer with the risk profile of the institution. Banks that are deemed riskier, therefore, face higher SyRB requirements. This leads to increased capital requirements, which in turn, curtails their lending capacity. By directly influencing the lending practices of banks, the SyRB serves to stabilize the financial system by preventing excessive risk-taking in areas most vulnerable to systemic disruptions. As shown in the graphic, the SyRB Calibration Rate determines the perceived riskiness of banks and thus the additional capital buffer required. Currently, this calibration is based on traditional financial risk metrics. To make the SyRB a pivotal tool in managing climate-related risks, its calibration methodology must be adjusted to effectively capture the complex nature of these risks, transforming it into a climate-adapted SyRB.

Initiating Climate SyRB Calibration: Insights and Methodologies

While a common climate calibration methodology for the SyRB does not yet exist, recent research from the ECB offers promising insights. The paper proposes a novel approach for adapting the SyRB to address transition risks in the euro area banking system. This methodology categorizes banks into different buckets based on their exposure to climate risks, estimated through the ECB top-down climate risk stress test (ECB CST). The forthcoming discussion will delve into this methodology in detail, starting with how the ECB CST assesses bank-level transition risk losses and how these findings shape the calibration of the Climate SyRB. The forthcoming discussion will delve into this methodology in detail, starting with how the ECB CST assesses bank-level transition risk losses and how these findings shape the calibration of the Climate SyRB.

Building on the insights from ECB research, the calibration of the Climate SyRB utilizes modified techniques developed within the ECB Climate Stress Test (CST). Initially, transition risks for individual banks are quantified through scenario analysis, incorporating both non-climate macroeconomic projections and climate-related shocks as outlined by the Network for Greening the Financial System (NGFS). To facilitate this analysis, two key scenarios are constructed:

- Baseline: Integrates the NGFS current policies scenario, which assumes minimal transition efforts, with macroeconomic projections by the ECB. This scenario is considered transition-risk free due to the minimal changes assumed.

- Accelerated Transition: Combines a front-loaded NGFS accelerated transition scenario, which assumes a rapid shift towards renewable energy, with the same macroeconomic projections as the baseline. This scenario captures significant transition risks from changes in the energy mix.

Following these scenarios, transition risk is quantified by leveraging granular risk models along with a broad array of available data, including confidential supervisory data such as COREP, FINREP, SHS, and Anacredit. Three interconnected risk modules are employed to analyze the data, each focusing on different narratives:

- Corporate transition risks: Changes in the energy mix, rising energy prices, and necessary green investments in the transition scenario led to increased operating expenses for firms, which ultimately results in a higher probability of default (PD) for these firms.

- Household transition risks: Higher energy prices in the transition scenario reduce disposable income, while simultaneously, the push for green investments increases household indebtedness. This combination exacerbates the debt-to-income ratio, leading to increased PDs for mortgages.

- Translation to bank-level losses: The increased PDs for corporations and households are then translated into projected bank-level losses attributable to heightened transition risks. This data is subsequently utilized to calibrate the Climate SyRB, ensuring that the buffer is tailored to reflect the financial impacts of climate-related transition risks effectively.

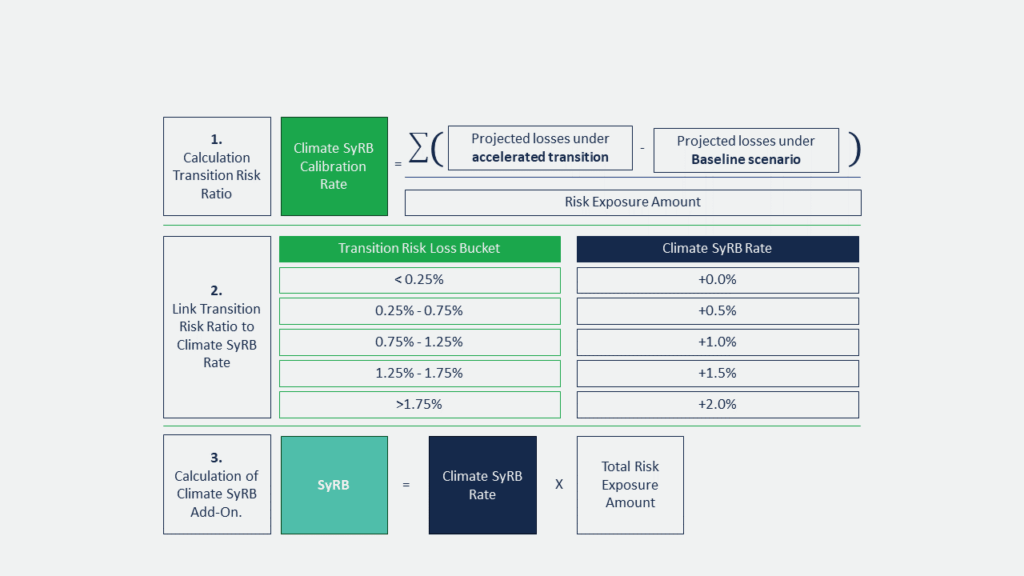

Detailed Calibration of the Climate SyRB: Isolating Projected Transition Losses

The bank-level losses in the accelerated transition scenario serve as an ideal basis for calibrating the Climate SyRB, as they encapsulate the effects of an unanticipated acceleration in the climate transition, leading to a system-wide shock impacting all banks. However, solely attributing the full magnitude of projected losses in this scenario to transition risks would be misleading, as they may also be influenced by the general macroeconomic assumptions applied in both scenarios. Since these macroeconomic factors are already considered in other capital buffers, they should not be duplicated in the calibration of the Climate SyRB.

To isolate the transition risk losses that are specifically attributable to climate change, the losses projected in the baseline scenario are subtracted from those in the accelerated transition scenario. This subtraction method is particularly effective because both scenarios incorporate the same macroeconomic shocks, with the primary distinction being the climate shock itself. By subtracting the losses observed in the baseline scenario—which lacks accelerated climate actions—this method focuses solely on the additional losses that are directly caused by the accelerated climate transition. This focused approach allows for a more accurate calibration of the Climate SyRB, ensuring it specifically targets the financial impacts directly associated with rapid climate change.

Following this, the isolated transition risk losses are utilized to determine a bank-specific climate SyRB, expressed as a percentage of risk-weighted assets (RWA). In compliance with EU law, specifically Article 133(9) CRD, the continuous transition losses are segmented into different buckets, each with a 0.50 percentage point width. The specific climate SyRB requirement for each bank depends on the bucket in which the financial institution is allocated. The value of the buffer matches the losses projected in the middle of the bucket, thereby establishing a direct link between the buffer requirement and the expected transition risk losses. This method ensures that the calibration of the Climate SyRB is both precise and aligned with legal requirements, providing a clear framework for financial institutions to manage their climate-related financial exposures effectively.

Operational Challenges of the SyRB Bucketing Approach

As highlighted in the ECB research paper, implementing a bucketing approach poses certain challenges, particularly for banks positioned near the cutoff points of the bucket borders. These borderline banks may be incentivized to adjust their activities and exposures to fall into a lower bucket. Such strategic behavior, especially prevalent around reporting dates, can lead to cliff effects, potentially exacerbating systemic risk rather than mitigating it. This issue underscores the need for careful consideration in the design and regulatory oversight of the bucketing system to prevent manipulation and ensure the integrity of the climate risk management framework.

Despite these challenges, the Climate SyRB framework provides a solid foundation for integrating macroprudential policy tools designed to manage climate risk. The research currently focuses solely on climate transition risks. However, the methodology could potentially be expanded to include physical risks or a combination of both physical and transition risks. Such an expansion hinges on a crucial requirement: banks and regulators must develop the necessary capabilities to estimate climate risks accurately and uniformly. Given the novelty of these risks and the scarcity of historical data on climate-related losses, this development is a significant undertaking.

Calibration Considerations and Policy Trade-offs

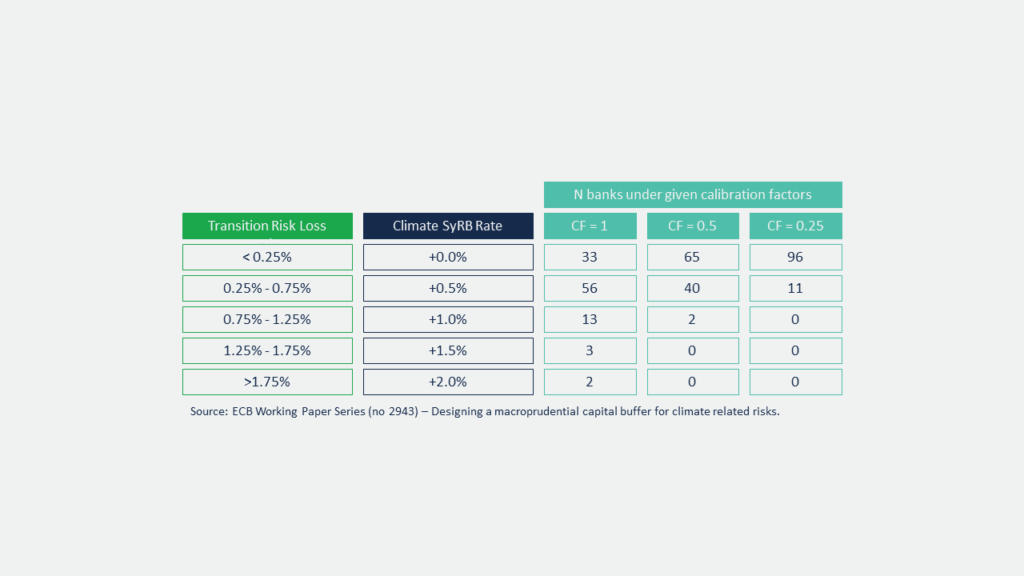

The results of the ECB research paper highlight the need for accurate and consistent climate risk estimates for the effective implementation of the Climate SyRB. The authors suggest that prudential authorities consider applying a calibration factor smaller than 1 to adjust the buffer for transition or climate losses. This adjustment accounts for overlaps with other capital requirements that might already mitigate some losses. A factor of 1 implies full coverage of projected losses by the SyRB, while a factor less than 1 indicates partial coverage.

This approach is valid if based on solid assumptions, but it significantly changes the buffer banks must maintain, as shown in the table below. This situation presents a policy trade-off: a higher calibration factor increases banks’ resilience against transition risks by boosting capital cushions but may restrict credit availability, potentially hampering the real economy and sustainable financing efforts. On the other hand, a lower factor avoids these negative impacts but provides limited protection against significant transition shocks. This delicate balance highlights the need for careful policy calibration, considering both financial stability and economic growth impacts.

Strategic Implications for Future Research and Bank Resilience

While this paper focuses on the immediate framework of the Climate SyRB, it also underscores the need for broader research, particularly in the selection of scenarios for effective implementation. Correct calibration of the Climate SyRB – potentially extending beyond transition risks – relies heavily on the sophistication of the underlying scenario analyses, which in turn depend on banks’ capabilities to conduct advanced climate risk stress tests themselves.

In this vital area, specialized expertise in stress testing and scenario analysis is crucial. RiskSphere, a consultancy firm with deep expertise in these disciplines, is uniquely equipped to assist banks in enhancing their data handling and analysis capabilities.

Partnering with RiskSphere

RiskSphere enables financial institutions to refine their scenario analysis and stress testing processes, resulting in more accurate and effective climate risk assessments. This improvement is not only essential for meeting regulatory demands but also crucial for ensuring that banks are well-prepared to face the diverse challenges presented by climate change, thereby securing their ongoing resilience and success.

Get in touch