The climate crisis presents both complex challenges and opportunities for the financial sector. In this article, we use the latest IPCC report to highlight how these changes impact your business. We demonstrate the benefits of innovative risk management strategies, including scenario analysis and climate risk stress tests, which can transform these challenges into pathways for sustainable growth.

Climate risk management: Navigating the heat in a changing world

The IPCC's alarming predictions

The recent release of the Intergovernmental Panel on Climate Change’s (IPCC) Sixth Assessment Report (AR6) has sounded a sobering alarm on the catastrophic consequences of global warming. The report highlights that human influence on climate warming is unequivocal, leading to unprecedented changes across the climate system. According to the latest scenarios, global temperatures will continue to rise until at least mid-century. The 1.5⁰C and 2⁰C thresholds set in the 2015 Paris Agreement are likely to be broken, unless deep greenhouse gas emissions cuts occur in the coming decades. Under a drastic, but increasingly likely scenario, global average temperatures could even surge by 1.5 ⁰C above pre-industrial levels as soon as 2030.

Breaching of these critical thresholds would trigger irreversible and devastating effects on our planet. The potential changes, known as ‘physical risks’, include rising sea levels, more frequent extreme weather events, and irreversible damage to our ecosystems. These physical risks can have severe socioeconomic consequences, such as mass migration and land loss. To mitigate these risks, a swift transition to a net-zero society is crucial. However, this transition, while necessary, may also introduce so called ‘transition risks’. These are challenges associated with the shift to a more sustainable economy, such as asset stranding and potential job losses in certain sectors.

On the flip side, the transition to a net-zero society also presents significant opportunities for innovation and sustainable development of which the rise of electric mobility and technological advances in solar energy are great examples. Importantly, there is still time to act to prevent the most severe impacts of climate change, and the strategic distribution of capital can significantly influence the trajectory of this transition.

From IPCC predictions to financial risks

The financial system, as a key financier, plays a pivotal role in accelerating the transition towards a net-zero society. However, it’s important to note that the sector, along with individual institutions within it, is also susceptible to climate risks. This creates a complex intersection where opportunities and risks converge. Navigating this landscape calls for a fresh perspective on risk management that promotes antifragility, which is the ability to adapt and thrive amidst new challenges. To do so, it is key to understand the specific risks and opportunities that financial institutions are facing.

On a micro level, imagine a bank with substantial mortgage exposures in low-lying areas of the Netherlands, such as the province of South-Holland. As sea levels rise, these properties could depreciate due to increased flooding risk and potential uninsurability, causing potential losses for the bank. In contrast, especially for individual institutions such risks can also turn into opportunities. A bank that has strategically invested in renewable energy projects, such as wind farms or solar power plants, can reap significant returns in the transition to a net-zero society. Certainly, this transition is not without its own set of risks. For example, assets tied to fossil fuels could become ‘stranded’, as they are no longer able to earn an economic return due to changes in the market or regulatory environment, leading to financial losses.

Climate risks may materialise far beyond the scope of individual companies, thereby causing systemic impacts and potentially trigger a financial crisis. When examining physical risks, a great example is the climate change exacerbated Thai floods of 2011, which severely disrupted semiconductor production and sent ripples through the global economy. However, for macro-level physical risks to have systemic impacts, specific conditions often need to be met, such as a geographical concentration of a specific sector, as was the case with the semiconductor industry in Thailand. Compared to physical risks, transition risks are often less constrained and can therefore have even broader effects.

As we shift towards a net-zero economy, sectors like renewable energy are poised for growth, while polluting industries such as oil and gas may face decline. This shift could lead to a reallocation of capital flows, potentially causing financial instability. For instance, if many investors suddenly decide to divest from fossil fuels and invest in renewable energy, this could inflate a ‘green bubble’ in the renewable energy sector and cause a crash in the fossil fuel sector. If these shifts happen too quickly or are not managed properly, they could trigger a broader financial crisis, inflicting severe losses on financial institutions.

Financial risk management in the climate era

Climate risks pose a significant threat to the financial sector, necessitating a shift in risk management strategies. These risks, characterised by their broad scope and interconnected nature, demand an approach adept at managing uncertainties over extended time horizons. As a response, many banks are now integrating essential tools into their risk management strategies. These tools, namely scenario analysis and climate risk stress tests, are crucial for navigating the complex landscape of climate risks and opportunities.

Global regulators are also acknowledging the need to enhance risk management in response to climate change, advocating for the integration of these tools into financial institutions’ risk management frameworks. For instance: the Bank of England has set a precedent with its 2021 Biennial Exploratory Scenario exercise, and the European Central Bank has issued a guide on managing climate-related and environmental risks, both endorsing the use of scenario analysis and stress tests. As other regulators follow suit, it becomes increasingly clear that these tools are crucial for maintaining financial stability in the face of the climate crisis.

Given the growing regulatory momentum and the critical role these tools play in navigating climate risks, it’s essential to understand what scenario analysis and climate risk stress testing entail. While interconnected and often used in conjunction with each other, the tools serve different purposed and thereby bring each their own unique insights.

Understanding scenario analysis

Scenario analysis, in its broadest sense, is a strategic planning tool that allows firms to explore the potential impacts of different future conditions on their business. Rather than attempting to predict the future accurately, the value of scenario analysis lies in its ability to prepare firms for a range of possible outcomes. In the context of climate change, firms often use ‘reference scenarios,’ which are commonly used projections of global emission trajectories, along with associated socioeconomic narratives and estimates of physical impacts.

Both physical and transition risk events can be investigated using scenario analysis. There are however distinct differences in the approach. Scenario analysis for physical outcomes uses emission trajectories to estimate temperature rise and corresponding climate events. However, due to the lag in the climate system, the physical outcomes of climate change are until approximately 2050 largely baked in by current emissions. This is not to say that there is no added value in this form of scenario analysis. At RiskSphere, we believe that its added value is in safeguarding long-term survival of firms, especially because measures to make firms and business models resilient against physical climate impact are challenging and take very long to successfully implement.

Scenario analysis for transition risks, on the other hand, can reveal more immediate variations. This approach examines whether a firm’s business model or portfolio align with specific decarbonisation pathways, allowing it to anticipate potential impacts of changes in policy, technology, and consumer preferences. By doing so, firms can identify potential risks and opportunities related to the transition to a net-zero economy and develop strategies to manage these risks and opportunities.

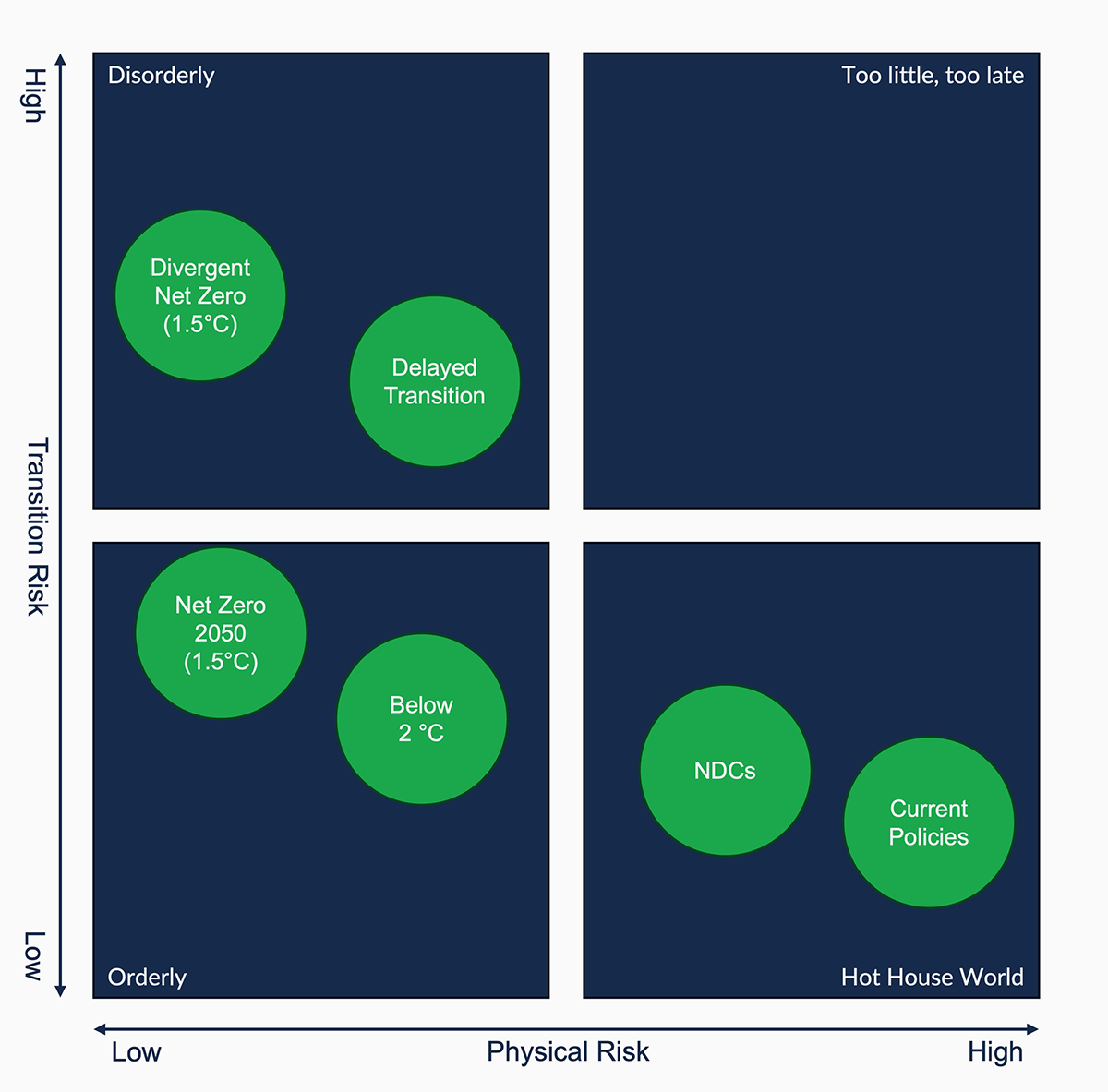

Within the financial sector, the reference scenarios of the Network for Greening the Financial System (NGFS) are the standard. These scenarios are developed through a collaborative process involving central banks and supervisors from around the world, and they provide a comprehensive framework for assessing both physical and transition risks. The NGFS has developed a framework consisting of four dimensions: Orderly, Disorderly, Hot House World and Too Little, Too Late.

The NGFS Scenario Framework

Source: NGFS, NGFSScenarios for central banks and supervisors (2022)

Each dimension represents a different set of physical and transition risk outcomes. Within this framework, the NGFS has developed six scenarios, based on plausible socioeconomic narratives. The NGFS scenarios can play a crucial role in learning to understand risks and opportunities across various time paths, as RiskSphere demonstrated at a Dutch promotional bank.

The powerful mix of scenario analysis and stress testing

Scenario analysis offers a robust framework for understanding potential future landscapes under different climate conditions. However, to assess the resilience of financial institutions under these scenarios, stress testing becomes indispensable. Stress testing, a risk management tool, evaluates the potential impact of different risk scenarios on a firm’s financial health. In the context of climate change, stress tests can be used to evaluate the potential impact of both physical and transition risks under different climate scenarios. RiskSphere believes that the integration of scenario analysis and stress testing allows financial institutions to gain a comprehensive understanding of their climate risk exposure and assess their resilience under different climate scenarios.

This combined approach is gaining traction as regulators worldwide are starting to require financial institutions to conduct climate stress tests. However, it’s crucial to understand that the full benefits of these tools can only be realized with a deep understanding of their applications and limitations. For instance, it’s a common misconception to directly compare climate risk stress tests with traditional financial stress tests, which can lead to inaccurate conclusions. Climate risk stress tests are typically focused on long-term impacts, while financial stress tests are temporary deviations from the long-term mean. Financial institutions must address these misconceptions to fully harness the power of these risk management tools.

Read more

Our next article ‘Climate risk stress testing: From predictions to preparedness’ continues this discussion by delving into other vital aspects of risk management in our evolving climate landscape.

Reach out for tailored advice

Armed with a clear understanding of the applications and limitations of climate risk stress tests and scenario analysis, you're better prepared to harness their power. At RiskSphere, we are dedicated to helping you navigate the complexities of climate risk management.

Get in touch